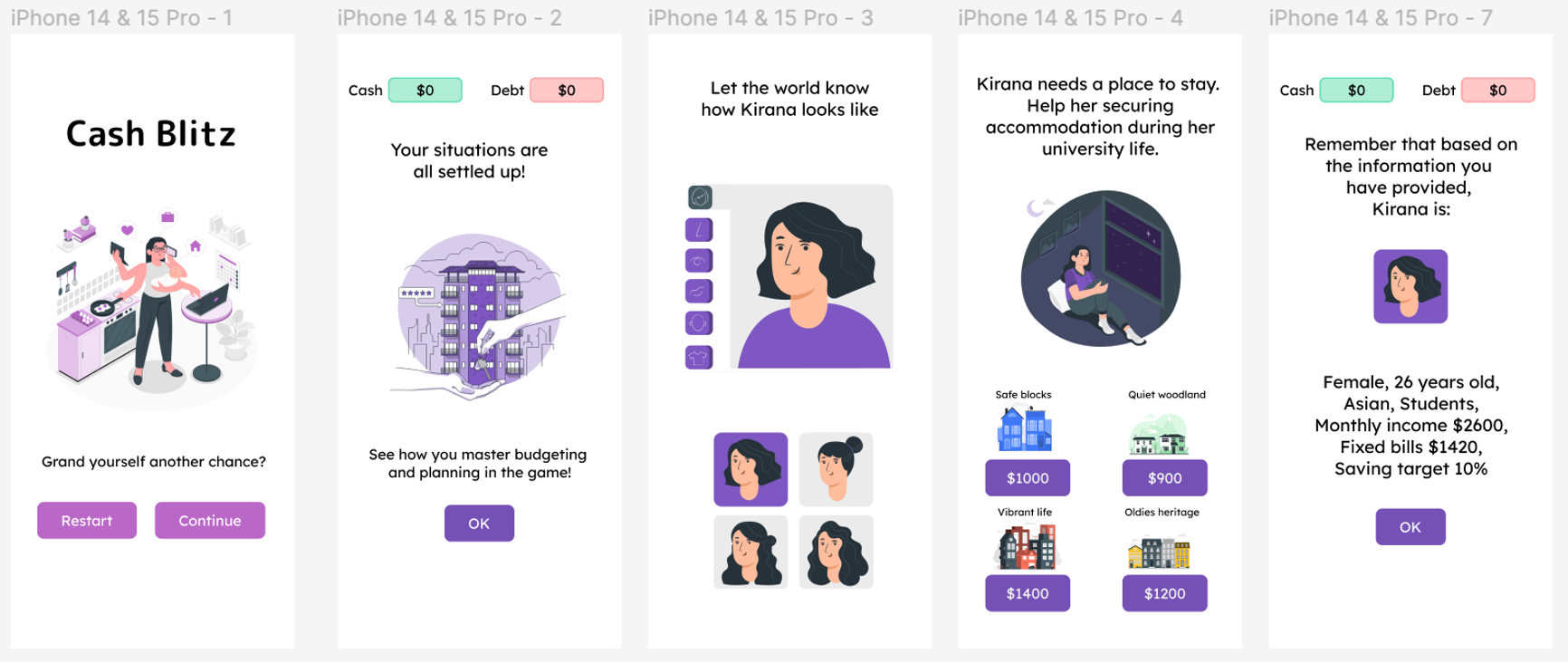

Cash Blitz prototype

Consumer spending awareness has become a prominent topic in discussions about financial behavior, with the widespread availability of spending trackers in mobile banking applications contributing to increased awareness of customers' purchasing habits. Nevertheless, despite the wide availability of resources and information about money management, there is a growing concern regarding the potential number of non-performing loans indicating borrower’s financial struggles (Khairi et al., 2021). Moreover, the poverty rate due to indebtedness is higher among young people (15–24 years old) than among older adults (Coffey et al., 2023). In particular, young people are reluctant to ask for help because of the solitary and personal experiences of humiliation associated with debt, overspending, and thoughtless financial choices.

Being aware that young people would rather experiment with their own money rather than ask for assistance or be upfront about their financial circumstances, I propose creating a gamification feature called Cash Blitz. Cash Blitz is a narrative game designed to delve into the player's habits and choices regarding cash management. This feature is expected to play a significant role in forecasting purchasing patterns and assessing readiness for financial risk, potentially benefiting e-commerce, banking applications, and individuals.

Gameplay and Prototyping

The gameplay component consists of two primary sections where users are expected to set their circumstances/settings and the systems will store scores in each progression.