Pilot study: Inducing first-time investor

The case

Bibit is a mutual fund investment platform focusing primarily on first-time investors. Our group vision is to help Indonesians manage their personal finances and invest in the right products so that they can improve their lives by achieving their goals and needs in the future. This year, Bibit has reached 5 Million users. To continue our leads in Indonesia, the goal is to help us gather insights from the people’s perspective of Bibit as a brand and how we should position ourselves as compared to our competitors.

Background and assumptions

Background

- Bibit has achieved 5 million users and is planning sustainable user growth among first-time investors.

- Bibit is in search of the right brand positioning to engage with its target market and win over competitors.

Assumptions to formulate problem statements

- The right segment leads to the right brand positioning. When brand positioning has not been made, it may be true that Bibit is still searching for the right segment too.

- The market size tells the growth direction: internet penetration is 73.7% (202 million), but Bibit share is 2.5% among the general population. Despite the fact that a real market size would be accountable once the right segment (targeted population) has been met, 5 million must not be saturated yet.

- Brand must map the needs and attitudes of its segment in order to create brand positioning. Baker et al. (2018) suggest one can classify investors through social demographics: age, gender, and wealth to be applied as initial criteria, but of course that’s not enough, so it’s our chance to comprehend the findings.

Research designs and questions

Research questions

- How are the characteristics of our segment?

- How are the decision steps (this includes but is not limited to the dynamics of psychological processes, trigger identification, and barrier identification) of their investing behavior?

- What are the comparative motives (pre and post thoughts) of their investing behavior?

- What are the important attributes (key drivers, hygiene, and opportunity) for the investment sector?

- What brand image that is already owned or can be strengthen by any of investment brands?

Research design

The main objectives above actually lie in how to tap into the target market. In order to deepen the knowledge and avoid heuristics, I propose to have a two-phase study: qualitative (especially when we do not have enough clarity on the sector) and quantitative (as a guide for business decisions in a more reliable manner).

Research plan phase 1: qualitative

Purposive sampling, with criteria:

- First-time investor from Baker et al. (2018)

- Male/female

- Start investing since November 2019 (2 years from data collection) in securities companies.

- Age: 18+

- More than 1 share in any stock, mutual fund, crypto, or obligation portfolio

- Additional criteria that fit with the Bibit target: have used at least an investment app (e.g., Bibit, Ajaib, Bareksa, Mandiri Sekuritas, etc.)

Design: in-depth interview, @45 minutes

Sample size: 3 to 8 individuals shall be enough

Timeline: 1-1.5 months

- interview guideline: 3 days

- participant soucing: 3-7 days

- fieldwork: 3-10 days (tentative)

- synthesis with thematic analysis: 2-5 days

- reporting: 5 days

Main questions

- As you have said that you are (mention the characteristics: e.g., have joined Ajaib in 6 months / currently have 2 stocks and 2 mutual funds in Ajaib / are always adding more funding on a monthly basis, are actively reading the investment news)… can I ask you to go back to the state when you first had the idea about investing and tell me how it has gone from that point to now?

- Could you please explain to me in any form what you know about your current brand?

- What makes you stay with your current brand as well as your investment instruments?

- What must be owned by a brand to make someone like you stick with them?

- Are you considering switching to another brand? If yes, what are the brand activities that might move you?

Research plan phase 2: quantitative

Criteria follow the qualitative one.

Design: survey with 35-45 questions.

Sample size: a minimum of n = 385 (MoE 5%), but strongly suggest n = 1000 (MoE 3%) for readable segments.

Questionnaire skeleton:

- Brand performance: top of mind, awareness, current used brand, brand used most often, future consideration

- Brand importance and image: a list of attributes gathered from qualitative data

- Persona questions

- Investment occasion

- Attitude:

- 5-point scales of psychological assessment: worldview, e.g., risk attitude, financial decision

- Activities, media, and demographics

- Social media activity

- Lifestyle, e.g., dining out, hobbies

- Age, gender, net worth, education, income, area, SES

Analysis: cross-tabulation, reliability test, and hierarchial clustering

Pilot results

Meet Andreas!

Andreas is a single man, aged 25 years old. He works for a tech company as a data scientist. The spending-saving ratio is 3:7, and the monthly income is more than IDR 10 million. He has a net worth above IDR 200 million. He spends his spare time playing computer games and reading.

- Andreas is an active user of Bareksa (mutual fund, fixed income: IDR 40 mios, 5 items) and Indopremier (stock, IDR 3 mios, 1 item).

- Investment milestones: Andreas has been investing since January 2020 in stocks and then expanding his instrument to mutual funds since May 2021. He plans to increase the assets in mutual funds to IDR 100 million and stock to IDR 20 million by 2022.

- Investment motivators: he is the type of guy who likes seeing his net worth grow and feels proud after making such an achievement.

- Investment drivers:

- Stock (Indopremier)

- Product knowledge: apply prior knowledge about investment.

- App: easy registration (paperless process), easy order process, fast trading time

- Feature: none (do not care enough at first)

- Mutual fund (Bareksa)

- Product knowledge: mutual funds (fixed income) are more stable.

- App: no-lag app

- Feature: sort by profit, various investment managers, various mutual-fund types

- Switching the portfolio ratio from stock to mutual fund

- No time to learn like professional trader

- Switching behaviours: He is pen to switching but do not have any brands in mind yet.

- Reason to switch: if there is an app that gives an up-to-date feature such as better visibility (chart or UI design), easy to use (sleekness), and leading brands have been figured out.

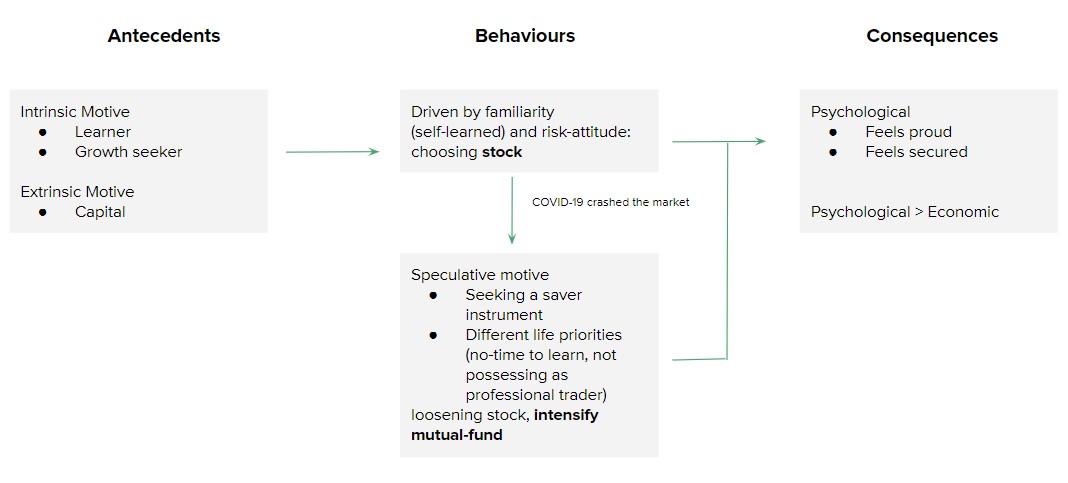

Psychological dynamics

Summary and way forwards

Questions Answers How are the characteristics of our segment? At this stage, we don't yet know the overall market characteristics. But we have figured out one out of all: "learner and growth seeker". A further study needs to be conducted among different subjects: mutual-fund first and churner/on-off users from different brands to overlook other characteristics. How are the decision-making steps of their investing behavior? Decision steps might differ, but for those with a "learner and growth seeker" disposition, they tend to take care of them and take needed action based on market volatility. What are the comparative motives behind their investing behavior? The goals are the same: number addition. This respondent has no stuck points as she is already internally motivated. But the way of investing differs depending on the situational factors, which mainly come from the market rather than brand competitiveness. What are the important attributes for the investment sector? In spite of app and feature primacy, a brand can emphasize the psychological benefits (trust, fear, security, knowledge addition, etc.) to overcome low economic gains as "learners and growth seekers" understand that this is the farthest return they can receive from a small investment. What brand image is already owned or can be strengthened by any of the investment brands? Can’t be answered at this stage; we need a quantitative study to get the insights through brand equity analysis.. - Stock (Indopremier)